Guest blog by Briony Phillips, Investment Activator

You might remember 2021 not so fondly as the second year of the COVID-19 pandemic but, take a moment to put your positive socks on and you’ll find a lot more to celebrate.

Before we leap into the exciting world of equity investment in the South West of England, let’s take a moment to reflect on some of the little known highlights of the year – did you know that The United Nations declared 2021 as the International Year of Fruits and Vegetables? Or that in September El Salvador became the first country in the world to accept Bitcoin as an official currency?

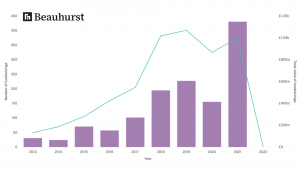

Right, with the light-hearted introduction out of the way, let’s focus on the topic we’re all here for – equity investment in the South West of England. The region has been on a broadly upward trajectory for the last 10 years and this year stands head and shoulders above the rest, nearly trebling the amount raised in 2021 and culminating in almost £500m raised in the final quarter of the year. In total 2021 saw 334 companies raise £1.14bn in 379 fundraising events according to our data partners Beauhurst.

The biggest raises in 2021 include some company names that you’ll no doubt recognise, raising their Series D and E rounds, and others that are much newer to the community. Let’s take a quick look at the top 10:

- Vertical Aerospace £214m – Vertical Aerospace develops aerospace technology, specialising in electric aviation for urban air travel.

- Graphcore £162m – Graphcore has developed a processor optimised for machine-learning tasks, and technology to accelerate machine learning applications both in servers and in the cloud. It also provides an open source machine learning development framework in C++ and Python.

- Netomnia £123m – Netomnia provides fibre broadband to businesses and homes.

- Huboo £60m – Huboo provides fulfilment services to e-commerce businesses.

- Ultraleap £60m – Ultraleap develops hardware that tracks spatial movements of the user, allowing them to interact with digital content.

- Immersive Labs £53.5m – Immersive Labs provides online training services for businesses, focusing on gamification to teach cyber security.

- Wildanet £51.5m – Wildanet operates a broadband service specifically providing for hard to reach, rural areas.

- Burrington Estates £47.5m – Burrington Estates develops and sells commercial and residential properties.

- Onbuy.com £39.37m – OnBuy.com operates an online marketplace which sells new and refurbished items.

- Clearbank £30.5m – ClearBank operates a clearing bank that aims to increase efficiency and transparency in the banking industry through its software, as well as automating a number of processes and speeding up payment processing.

In total, 334 companies raised equity funding in 2021 across the South West, ranging from £162million to £5,000. This year 15 companies raised over £10m, 60 companies raised over £1m and a further 75 companies raised between £100,000 and £250,000.

Three fifths of the companies that raised equity investment in 2021 are operating within the technology or IP based sectors and the second most prevalent sector is business and professional services quickly followed by the industrial sector and leisure and entertainment.

The geographic spread of investment in tech is well captured by the investment map published by SIFTED last year, the infographics that accompany it provide a really engaging summary of the South West community – find it here.

Commentators are already speculating on the next ‘unicorn’ companies that will be crowned in the South West in 2022, do follow our updates through the Investment Activator Programme.